How to write an invoice

If you’re reading this then it’s safe to presume that you’ve either started or you’re looking to start working for yourself. Whether you’re a freelancer or a business owner, nailing your invoicing is a key part of financial management.

We’re all required to keep clear records of our income and outgoings for Tax purposes, but how do you know what you need to include on your invoices, or how to determine which documents you should keep hold of?

When I got my first freelance job, I was so excited and ready to prove myself. I was doing my best to come across as capable and professional (despite being a very awkward 16-year-old). So when they asked me to send over my invoice I panicked. What was I supposed to put on an invoice? Just my fee? I was so worried I’d miss some important information and highlight my inexperience that I spent ages on Google comparing templates and searching for advice.

We’ve all been there at some point or other so whether you’re in that same position that I was and you’re sending out your first invoice, or if you’re super experienced and just looking for some tips to tidy things up. I am here to show you exactly how to write and format a professional invoice.

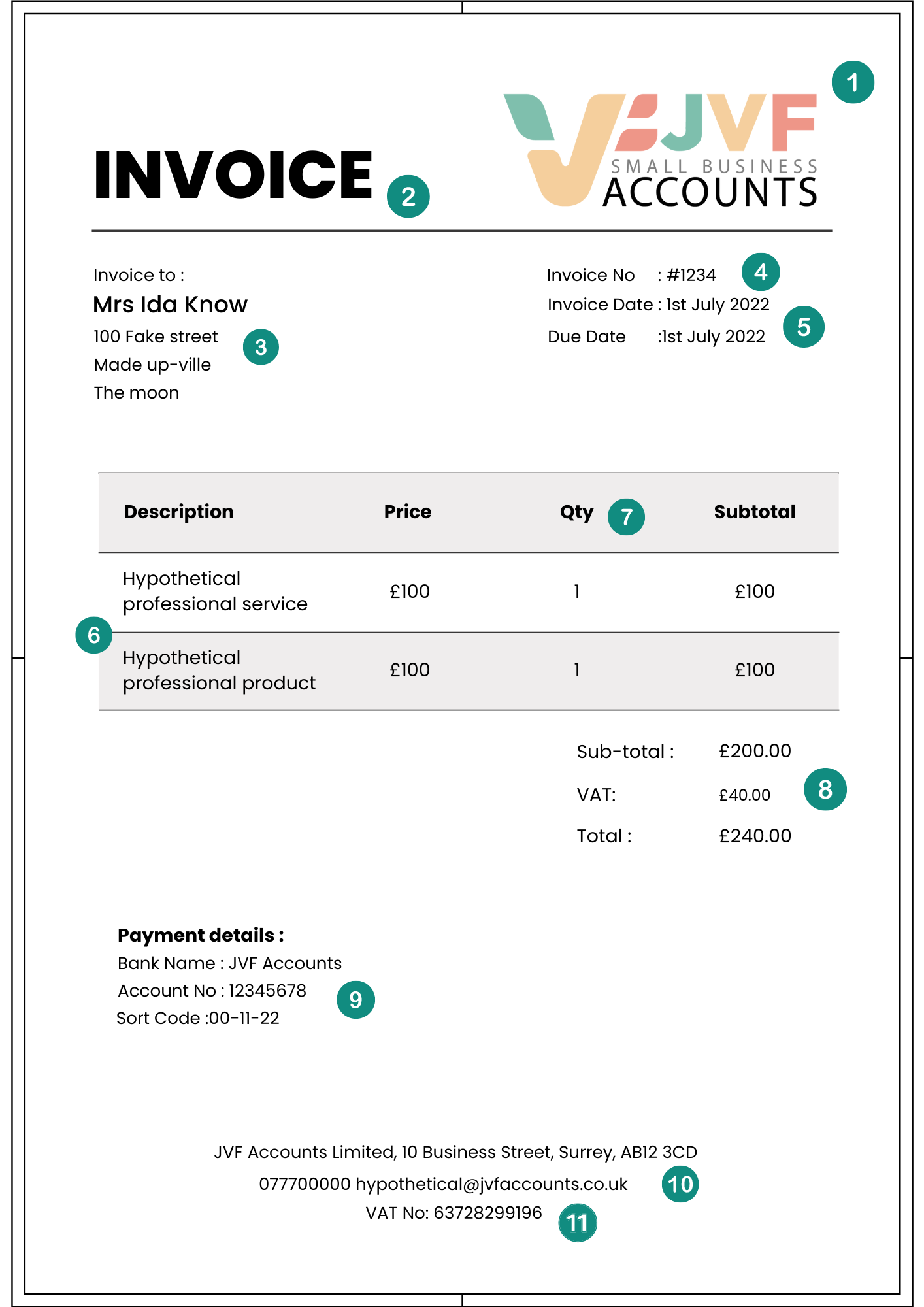

It may seem obvious but the first thing you need to do is add your logo! Your clients need to know at a glance who this invoice is from. Positioning is important here, marketing professionals will tell you that the most important information should be at the top of the page. But to make it professional ensure it is well sized to be readable and in the right format to avoid pixelation and awkward mismatching backgrounds.

Your document type - make sure you clearly state that this document is an invoice. Often people will confuse invoices with quotes, statements and even delivery notes. They need to know which of these is the one that they need to keep and more importantly - the one that they need to pay!

Address your invoice! Not only do you need to make it clear to your client that this invoice is intended for them, but properly addressing your invoice will save you a headache when you’re doing your bookkeeping too. You’d be amazed how many people forget to include their client's name.

Invoice number - Again this is essential for both you and your client to track which invoices are outstanding and which have been paid. It doesn’t matter if you start at number 1 or number 1000 here, just ensure that each invoice you send has a unique number, regardless of the recipient.

Invoice date - this isn’t just important to keep your invoices organised, including a due date will set clear expectations with your clients and will also make it easier for you to match invoices to payments in your bank.

Product and service descriptions. Be as clear as you can here, if you have an internal numbering system for your products feel free to include them so that you can easily identify to yourself what you’ve sold but also ensure your description will be easily understood by your client

Giving a quantity will keep things tidy rather than repeating yourself and will also make it easier for clients to understand how the cost is broken down specifically if you’re referring to hours worked.

Of course you’ll need to provide a total. If you’re VAT registered you’re required to state the amount of VAT. I’d recommend laying this section out separately so that it stands out or even putting your gross total in bold so that clients can see at a glance how much is due to be paid.

Don’t forget your payment details, make it easy for your clients to pay you. If you’re invoicing overseas be sure to include your IBAN and BIC numbers. If you accept payments via Paypal or Venmo etc include that here too. If your invoices are digital you could even include a link here.

HMRC requires your official company name, address and contact information to be included. But it's also important for your clients to know where to direct any questions that they might have.

Finally, for VAT-registered businesses, don’t forget to include your VAT number as required by HMRC.